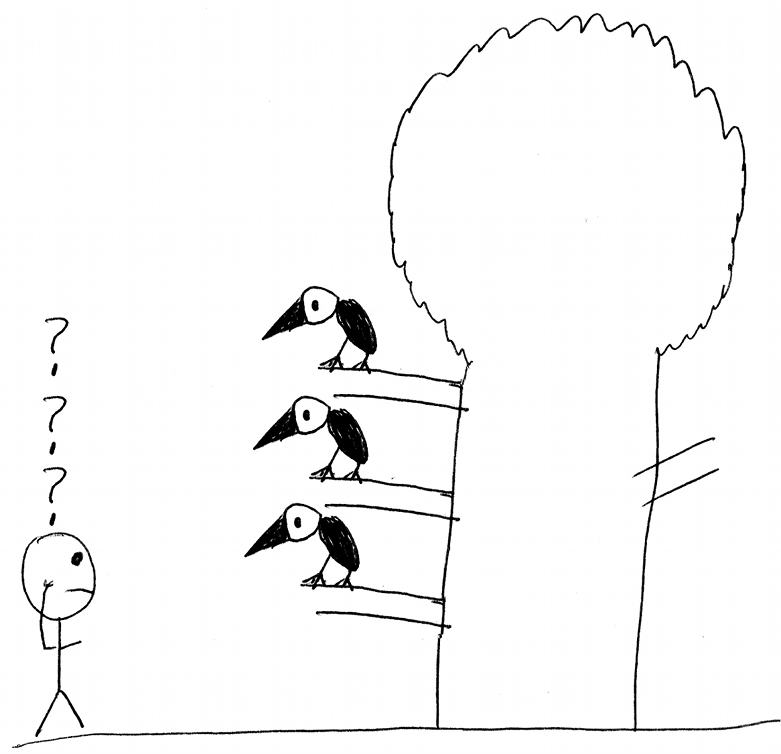

I was of three minds,

Like a tree

In which there are three blackbirds.

– Wallace Stevens

OK, so the market is down which has been the rare event for months on end.

Every time we see even a one day sell off, bearish views come out of hibernation on my stream ranging from the apocalyptic to the sober and smart.

I have written about heightened sentiment volatility extensively already, but to summarize briefly – sentiment volatility is a big deal, because when bearish extremes occur quickly and on shallow corrections, it means that money is out of the market and might come back in just as quickly, ultimately fueling the start of the next leg higher.

I have no idea where the market goes next, although my broad bias is that we are in a bull market, and I am of three minds like Wallace Stevens’ tree. Key here is this – All the opinions I read, no matter how sober or how smart, are only guesses about the future based on an imperfect and unpredictable data set. This is classic decision making under uncertainty and it defines markets.

I don’t really care about not knowing, because I have a general strategy and tactics to support the strategy.

I want to wade into multi-day pull backs when they present themselves and sell calls for yield enhancement when the market is overbought. As a result of this being my approach, I am under-invested and have been to varying degrees for a while but that is alright.

Thanks to The Hooded Utilitarian who is the source of the above drawing. Check his post on the Stevens line I quoted above. Its a thoughtful read…