Some of you are familiar with the on tilt phenomenon from the poker world.

If you’re not, it goes like this. Tilt sometimes occurs when a poker player experiences a bad beat or a series of them. After the beat, the player loosens dramatically playing more hands, increases risk irrationally and acts out. Often this leads to a quickly blown stack of chips.

This is not something that only novices do. If you ever watch The World Series of Poker on ESPN, you’ll occasionally see a pro lose a big pot and then, on the very next hand, get caught up in a hand that he or she should not be in.

You can see this happening now with Bill Ackman.

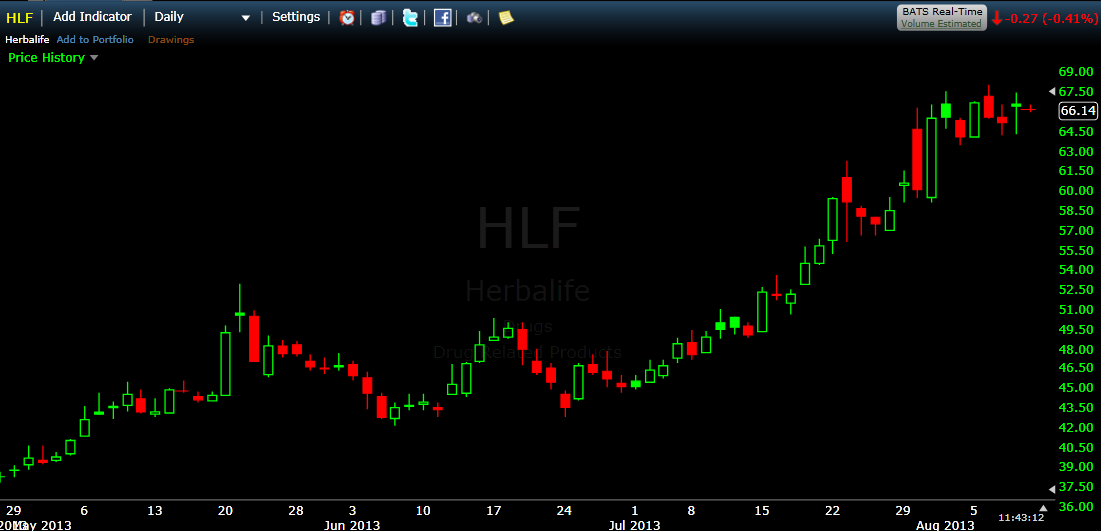

Ackman’s bad beat was (and still is) Herbalife where he is getting hammered by Icahn, Soros and a heavily shorted stock that looks great on the chart and keeps rising.

So, onto the next hand, $JCP, where Ackman appears to be behaving irrationally.

As Jeff Mathews writes,

But his gambit yesterday—leaking on CNBC a letter to the board of JC Penney, of which his hedge fund is the largest shareholder, that urges pushing out the same CEO he just brought back (Myron Ullman) after pushing him out once before in favor of ex-Apple genius Ron Johnson, who pretty much destroyed the JC Penney as we knew it in favor of a slicker, more upscale thing called ‘JCP’ (the stock ticker, get it?) which JCP’s customers did not get at all, and from which they left in droves—smacks of desperation.

The dynamics of tilt can be understood best by way of prospect theory. Prospect Theory stems from the research of Kahneman & Tversky and suggests that humans sometimes neglect probabilities and make decisions based, in part, on whether they are framed by losses or gains. The implication is that humans are inherently loss averse and prefer to avoid losses at the cost of rational decision making.

Kahneman and Tversky put it this way: Losses loom larger than gains.

So people hate to lose and when they are faced with the prospect of loss, especially in a big way, they tend to act more on emotion than expected utility. In the case of tilt, the player will try to avoid the realization of the lost chips by attempting to get them all back at once without consideration of the odds.

In the case of Bill Ackman, the $HLF loss is shaping up to be a big ugly bad beat and very public one, so not only are we seeing the behavioral effects of loss realization avoidance but we are also witnessing a large ego bruised at the hands of two of the biggest (Soros and Icahn) to ever play the game.

The rational response to a bad beat is to do less and risk less not more which would probably be the move for Ackman to make here until he can get his head together with the $HLF situation.