Love love love pulling a few of this morning’s most interesting studies from The StockTwits Charts Streams for your viewing pleasure….

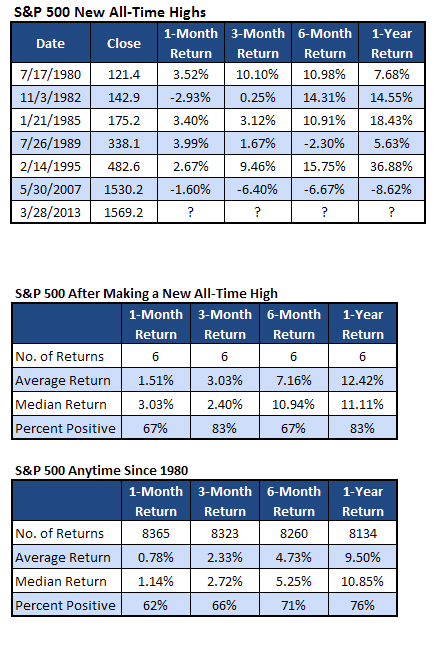

1. All Time Highs Tend To Beget All Time Highs: Call it momentum, inertia, positive feedback loops or whatever, markets (and stocks) that make new highs have a tendency to continue higher. This is the stuff that trend trading is made of. Here, @RyanDetrick provides clear cut backtesting stats to clarify the phenomenon on the S&P 500. He writes, “When $SPY closes at an all-time high, it actually outperforms average returns on all time frames.” See his work below:

2. Continued Defensive Leadership: Recently, traders and the media have been focusing more and more on the leadership of traditionally defensive sectors, in particular Health Care ($XLV) & Consumer Staples ($XLP). Since the beginning of the year, these sectors have extended their leadership no doubt. Key here though, and what few are mentioning, these sectors have been leading since the big 2009 bottom. @Ivanhoff makes it abundantly clear here:

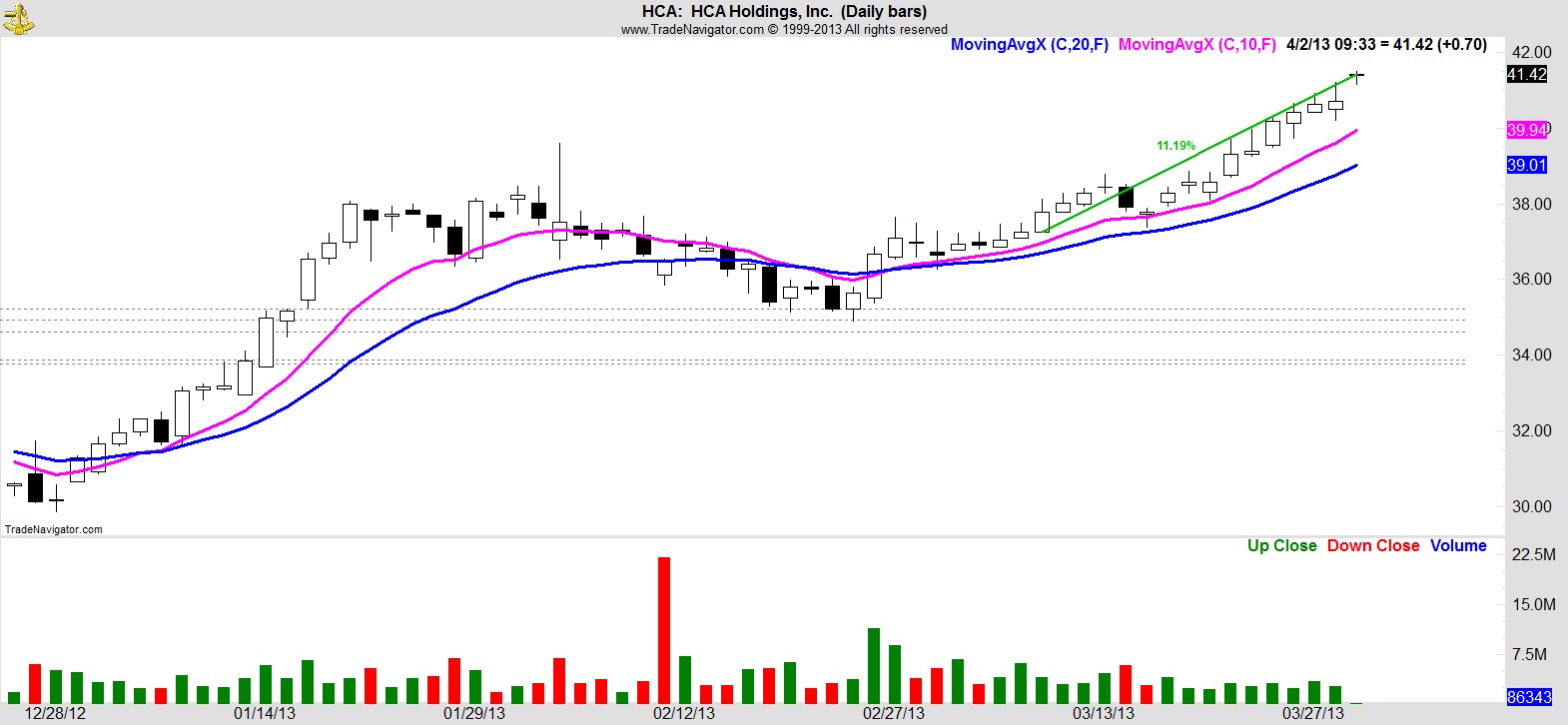

3. For Example, HCA Holdings Beast: @JBoorman zeroes in on one healthcare stock in particular, $HCA, and notes the incredible recent strength in the name, “10 straight up days, 7 straight all time highs…”

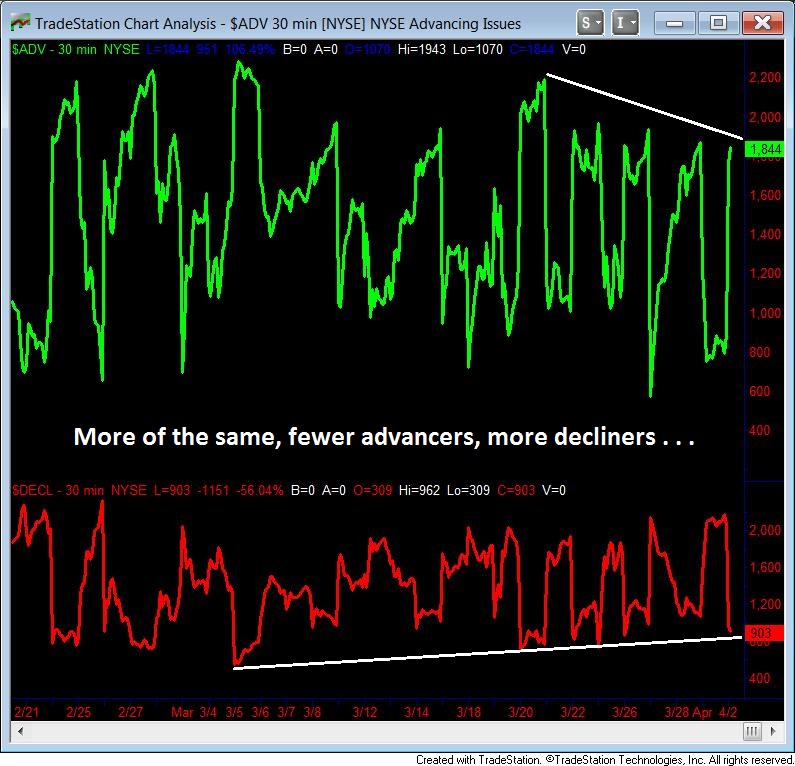

4. Index Halitosis: To curb our enthusiasm a bit, here’s @MarzBonfire displaying a pesky set of divergences that he doesn’t like seeing while stocks make all time highs. Decliners are advancing and advancers are declining: