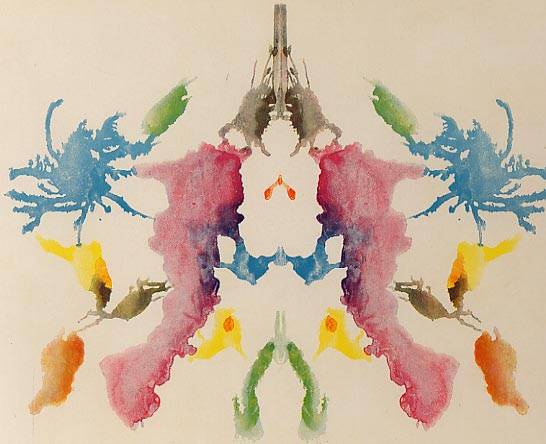

Commonly, when sentiment gets extreme, its pretty straight forward, simple even. We get something like diagnoses A & B below:

Diagnosis A: Bearish Simplex – Market gets killed, everyone gets negative and scared.

We are all fearful of losses and so extreme consensus bearish sentiment can be harrowing and we use words like panic to describe. Usually, we can also observe reflections of consensus bearishness in the reading of several indicators including the put/call ratio, the $VIX and the AAII Seniment Survey which I highlighted last week.

Diagnosis B: Bullish Simplex – Market rallies over a sustained period, most get positive and discount risk.

Generally, we just love the bull market. People’s moods improve, we buy stuff, companies hire and even hemlines rise with the market. Meanwhile, the same indicators mentioned above flash progressively extreme bullish readings…

Diagnosis C: Conflicted Complex – Market rallies over a sustained period while most feel strongly mixed.

Sometimes, though, things can get much more complicated such that the market indicates strong mixed feelings. Think about it, we humans have big complex brains and we are capable of experiencing strong mixed feelings, well, so is the collective market.

We have this situation now where most are feeling emotions associated with a bull market but at the same time they feel as if some shoe will imminently drop as shoes have been dropping left and right for 14 years now.

You see it in headlines but can observe it most succinctly in the mixed messages of two indicators. The $VIX is making low after low, suggesting expectations of continued subdued volatility. Meanwhile, though, the AAII Sentiment Survey shows significantly lower than average bullishness and higher than average bearishness.

This Diagnosis C is less common than A & B and so even experienced traders, who have learned to read market sentiment and adapt to their own, have some confusion here.

I am watching for fast changes in the extremes as a market tell. For ex: How quickly does the bullishness dissipate when the maket pulls back even a little? How much further in this rally until the bearish aspect of the complex diagnosis break down?